Our 2025 Sustainability Report is here! Dive in.

Inflation Reduction Act is a Game-Changer for the Climate and Energy Consumers

August 15, 2022 •Lloyd Kass

For many of us tracking (or more accurately, riding the rollercoaster of) climate and clean energy lawmaking in the US Congress, it was both a surprise and a thrill to see such a substantial package advance through the Senate and the House toward enactment over the last week. My Franklin Energy colleagues and I—and fellow energy efficiency geeks everywhere—are particularly pumped about the huge opportunities the Inflation Reduction Act (IRA) offers residential energy consumers. I will address the historic home energy efficiency and electrification pieces of the IRA below, but let's start with a look at the bill’s overall climate impacts.

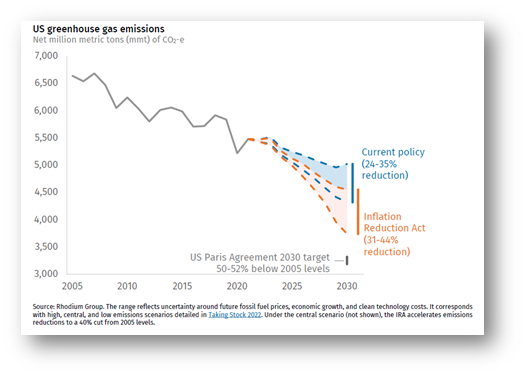

| Leading independent energy economists and policy modelers agree that the IRA will get us about two-thirds of the way to the Paris Agreement’s 2030 emissions target—which is a 50-52% reduction over 2005 levels. A model from Rhodium Group, as presented in the figure to the right, anticipates a GHG reduction range, but their central estimate is 40%. |  |

The IRA will accelerate America’s trajectory for curbing emissions, but how does the law actually make it happen? Princeton professor and #energytwitter influencer Jesse Jenkins describes it in clear terms in a recent Twitter post:

| “The Inflation Reduction Act cuts US emissions primarily by making clean energy cheap, through tax credits, grants, rebates, and loan programs that will make it easier for households, businesses, and utilities to electrify and adopt clean energy, clean fuels, and clean vehicles.” |

There is a lot of talk about the IRA’s impact on large-scale renewable energy development and clean tech manufacturing, but first let us discuss the residential energy efficiency components. First off, the IRA amends the federal tax code in many ways to the benefit of efficiency:

Efficiency Home Improvement Credit. Section 25C will be modified to enable homeowners who make bread-and-butter efficiency investments (insulation, heating equipment, etc.) to claim up to $1,200—or 30%—of the project costs in their tax returns. Up to $2,000 can be claimed if a heat pump is part of the retrofit, with an additional $600 available for an electrical panel upgrade and another $150 for a home energy assessment performed by an accredited field technician.

*Important Note: While in the past, the 25C credit was available once during the lifetime of your ownership of the property, the IRA changes the rules such that it will be available EVERY YEAR as additional eligible investments are made. This is a momentous change for homeowners.

Residential Tax Credits for Solar, Geothermal, and Fuel Cells. Under the tax code’s Section 25D, 30% of the costs of rooftop solar, geothermal systems, or fuel cell installation can be claimed separately and/or on top of any efficiency investments.

New Energy-Efficient Home Tax Credit. The law also extends the availability of the tax code’s Section 45L, providing $2,500 for homes meeting certain ENERGY STAR standards and $5,000 for DOE Zero Energy Ready Homes if prevailing wage labor requirements are met.

Now, let’s cover the nearly $9 billion in new funding for single-family and multifamily efficiency programs, rebates, and grants—with an emphasis on serving low- and moderate-income consumers. There are too many details to fully cover here, but these are the highlights:

The HOMES Program. This program sends $4.3 billion to state energy offices for whole-house efficiency retrofits. Up to a $4,000 incentive is available for projects based on the post-project energy savings performance of the home. And the rebate amount is $8,000 for moderate-income households (up to 80% of median income). Multifamily building owners are also eligible for similar incentives on a per dwelling unit basis.

The High-Efficiency Electric Home Rebate Program. An additional $4.5 billion will be directed to state energy offices to set up rebate programs targeting the efficient electrification of low- and moderate-income single and multifamily households (up to 150% of median income). Rebate levels are as follows:

-

- Up to $1,750 for a heat pump water heater

- Up to $8,000 for a heat pump for space heating or cooling

- Up to $840 for electric cooking equipment or a heat pump clothes dryer

- Funds are also available for upgrading wiring, electrical panels, insulation, and air sealing.

Efficiency and Resilience Investments in Affordable Housing. Through the federal Department of Housing & Urban Development, the IRA directs $837 million in grants and loans for energy and water efficiency, electrification, clean distributed generation, and climate resilience in affordable housing.

Now imagine this. A couple years from now, you are a resident of a home considering making energy improvements. You and/or your contractor of choice are attempting to navigate one or more of the new programs in the IRA, separate rebates, and other offerings from each of your utilities (e.g., gas, electric, and water). Perhaps at your salary level, the Weatherization Assistance Program or another income-eligible program may be available. Think about trying to navigate all these programs and make sure you are taking the tax credits. Suffice to say, there will be a lot of program planning and design issues to sort everything out in the coming weeks and months—and Franklin Energy can help. We bring the knowledge to streamline the customer and contractor experience and support efficient implementation of these overlapping offerings.

Franklin Energy has offices and feet on the ground—passionate energy professionals—in more than 30 states, and we currently operate more than 75 discrete single and multifamily energy efficiency programs. We processed $82 million in residential rebates last year alone. We are ready to assist states in optimizing the IRA to make the greatest impact on the largest number of citizens.