Our 2025 Sustainability Report is here! Dive in.

Electricity Delivery and Management: A Look Back at 2018 Growth and a Look Ahead to Emerging Markets

August 26, 2019 •Franklin Energy

If you haven’t read through the Advanced Energy Now 2019 Market Report, *SPOILER ALERT* it’s full of great news for the future of the advanced energy industry. In short, 2018 was a year of promising growth. Advanced energy generated $238 billion in revenue and supported 3.5 million U.S. jobs — an 11 percent increase over the previous year. That’s on par with the aerospace manufacturing industry and double the biotechnology industry.

Electricity Delivery and Management: Exciting Growth

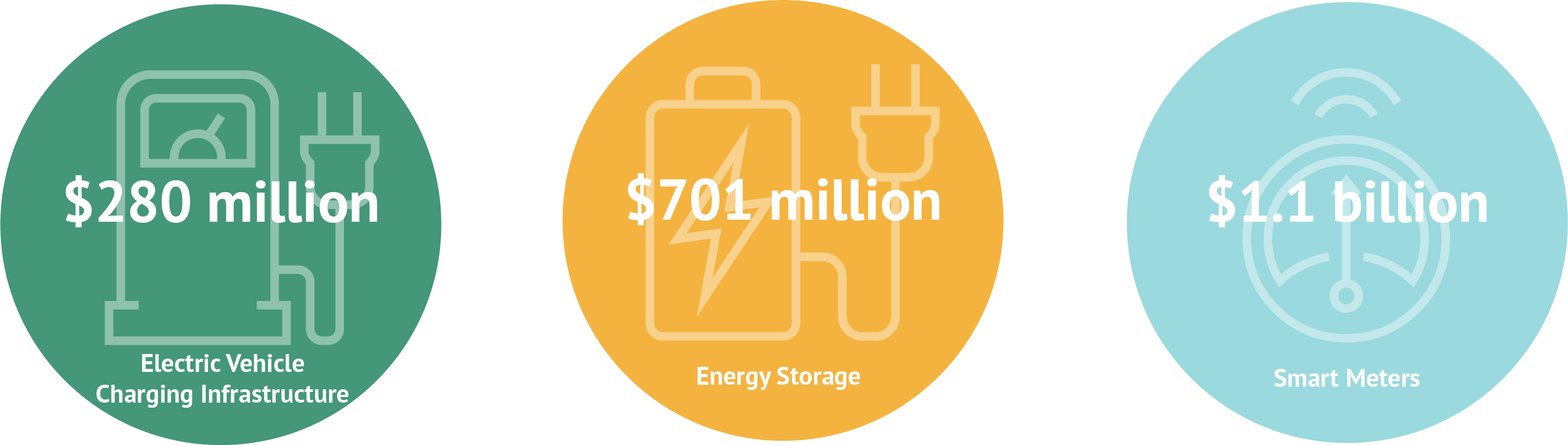

Of the seven segments that comprise the advanced energy industry, Electricity Delivery and Management products and services recorded the highest compound annual growth rate (CAGR) from 2011 to 2018 both worldwide and in the United States. Here are 2018’s notable revenue stats:

Electric Vehicle Charging Infrastructure

In addition, this growth followed one of the biggest years for electricity delivery and management, which recorded 28 percent growth globally and 14 percent in the United States. The largest subset continued to be transmission at $55.4 billion worldwide, led by large investments in transmission infrastructure and grid management technology. While mature, this area continues to grow steadily where progressive energy policy dictates, in particular, California, New York and Hawaii.

Looking ahead, while transmission is sure to continue leading in revenue, the next decade promises significant investment in infrastructure development for electric vehicle (EV) charging, energy storage and microgrid technology. Let’s take a closer look at what the report tells us about these three trailblazing distributed energy resources.

#1 EV Charging Infrastructure: Catching up to EV Demand

For years, the EV market has been characterized as a true chicken-or-egg situation: should EV adoption drive charging infrastructure or will investing in charging infrastructure positively influence EV sales? According to the Advanced Energy Now 2019 Market Report, “range anxiety,” the fear of running out of charge, is still a major barrier to more widespread adoption. The good news is that significant advances in battery technology have both reduced EV battery costs and vehicle prices while also increasing vehicle range per charge. These advances are helping to reduce range anxiety concerns and accelerate EV adoption. Seeing this increased demand for EVs and associated services, many organizations have started investing significantly in charging infrastructure, including DC fast charging and ultrafast charging.

For years, the EV market has been characterized as a true chicken-or-egg situation: should EV adoption drive charging infrastructure or will investing in charging infrastructure positively influence EV sales? According to the Advanced Energy Now 2019 Market Report, “range anxiety,” the fear of running out of charge, is still a major barrier to more widespread adoption. The good news is that significant advances in battery technology have both reduced EV battery costs and vehicle prices while also increasing vehicle range per charge. These advances are helping to reduce range anxiety concerns and accelerate EV adoption. Seeing this increased demand for EVs and associated services, many organizations have started investing significantly in charging infrastructure, including DC fast charging and ultrafast charging.

Our sister company has the inside scoop on the information all first-time EV owners need to know!

For utilities, EVs represent the largest opportunity for load growth, especially since municipal, regional, and national governments are pushing for EV adoption (with some incorporating EV charging networks in their long-term transportation plans). And while growth in this market tracked at around 25 percent in 2018, the United States is still catching up to the rest of the world, leaving a lot of potential for future growth.

#2 Energy Storage: A Growing Grid Optimization Solution

Thanks to traditional generation replacement investments and newer pushes for renewables-plus-storage projects, energy storage revenue in the U.S. has climbed from $58 million to $701 million over the past five years.

Thanks to traditional generation replacement investments and newer pushes for renewables-plus-storage projects, energy storage revenue in the U.S. has climbed from $58 million to $701 million over the past five years.

One of the most notable examples of traditional generation replacement used for utility-scale storage was Pacific Gas and Electric’s (PG&E’s) plan to replace three power plants in its service territory with storage solutions. “Deploying strategically located energy storage will help lower operating costs and address congestion issues in the region,” reports the Advanced Energy Now 2019 Market Report.

Send this blog to a colleague!

Globally, the industry is also expecting growth in renewable-storage hybrid plants. In areas where an abundance of wind and solar energy must be curtailed, Li-ion battery can help store that energy for future use. Additionally, these same batteries can be utilized to provide valuable ancillary services like frequency and spinning reserves. These help stabilize the grid and maintain power quality, allowing more variable and renewable generation resources to be built.

#3 Microgrid Technology: Seeking Self-Sufficiency

Since 2016, the microgrid market has grown by leaps and bounds, and by 2018, U.S. revenue from microgrids was just under $2.5 billion (35 percent of the global market). Large customers such as hospitals, universities and military bases turn to microgrid technologies to separate themselves from the grid and be self-sufficient during outages. The growing interest can be attributed to an increasing number of these large consumers demanding a completely uninterrupted supply of power. Additionally, we are seeing an increase in extreme weather events (such as wildfires, floods, earthquakes and hurricanes) that threaten reliability and lead utilities to be increasingly exposed. As a result, utilities are now planning to interrupt power to millions of customers for multiple days in some of these cases! Customers can now expect to have their power interrupted. This reduction in service expectations combined with an increased demand for zero downtime and advances in microgrid technology is leading to a significant increase in microgrid deployments. Navigant Research expects total microgrid capacity to grow from 3.2 GW in 2019 to 15.8 GW by 2027.

Since 2016, the microgrid market has grown by leaps and bounds, and by 2018, U.S. revenue from microgrids was just under $2.5 billion (35 percent of the global market). Large customers such as hospitals, universities and military bases turn to microgrid technologies to separate themselves from the grid and be self-sufficient during outages. The growing interest can be attributed to an increasing number of these large consumers demanding a completely uninterrupted supply of power. Additionally, we are seeing an increase in extreme weather events (such as wildfires, floods, earthquakes and hurricanes) that threaten reliability and lead utilities to be increasingly exposed. As a result, utilities are now planning to interrupt power to millions of customers for multiple days in some of these cases! Customers can now expect to have their power interrupted. This reduction in service expectations combined with an increased demand for zero downtime and advances in microgrid technology is leading to a significant increase in microgrid deployments. Navigant Research expects total microgrid capacity to grow from 3.2 GW in 2019 to 15.8 GW by 2027.

At Franklin Energy, we’re excited about the changing electricity delivery and management landscape, especially as it relates to commercial and industrial programming. To learn more about how Franklin Energy can work with your utility to implement these innovations, schedule a meeting with an expert today!